Indices Trading

Indices track the performance of a selection of stocks listed on a stock exchange, offering a comprehensive snapshot of market trends.

- Speculate on a group of shares for less than the cost of trading them individually

- Get exposure to an entire sector or economy at once

- Hedge against a drop in the value of your share portfolio

We offer over 30 more weekly trading hours than our nearest competitor, so you can

What are indices ?

-

Indices are financial instruments that represent the performance of a group of stocks from a particular market or sector. Popular indices, such as the S&P 500, Dow Jones, and FTSE 100, track the value of top companies within a specific region or industry, providing a snapshot of overall market performance

-

What are indices? They allow traders and investors to gauge the health of markets and make informed trading decisions. Rather than focusing on individual stocks, trading indices offers exposure to a broader market, helping to diversify risk and capture wider economic trends.

Benefits of index trading

-

One of the key benefits of index trading is diversification. By trading an index, you gain exposure to a wide range of stocks in a single trade, reducing the risk associated with focusing on individual shares. This allows traders to invest in entire markets or sectors efficiently

-

The benefits of index trading also include lower volatility compared to individual stock trading. Indices reflect the broader market, which tends to be more stable over time. Additionally, index trading offers the opportunity to profit in both rising and falling markets through long and short positions.

Why You Should Trade With Us ?

Execution

Reliable and precise trade execution every time.

Premium Trading conditions

We provide exceptional trading conditions tailored for traders of all levels,

Fast & easy registration

taking just minutes with our seamless digital registration proces

Negative balance

Negative balance protection ensures that your account never stays below zero

Safety of funds & data

Your security is our top priority, ensuring your funds and personal information are fully protected,

Friendly, expert support

Get friendly, expert support 24 hours a day except for Saturday day except for Saturday

Choose Your Account

Standard

The most popular account type for beginners. It provides balanced conditions for trading on the currency and other types of markets.

- Trading platforms

- Trading terminals

Instruments

More than 100

Minimum deposit

10 USD

Spread

Starting from 30 pip

Execution type

Market Execution

Gold

An account type with the best trading conditions available at the Gold Eagles company. It is suitable for both currency and other types of markets.

- Trading platforms

- Trading terminals

Instruments

More than 100

Minimum deposit

5000 USD

Spread

Starting from 16 pip

Execution type

Market Execution

VIP

The choice of experienced traders, which combines the highest order execution speed and competitive trading conditions.

- Trading platforms

- Trading terminals

Instruments

More than 100

Minimum deposit

10000 USD

Spread

Starting from 8 pip

Execution type

Market Execution

Dive Deeper into Trading: Expert Insights and In-Depth Articles

- Indices

- February 3, 2025

What are indices ?

- Indices

- February 3, 2025

Benefits of index trading

- Indices

- February 3, 2025

How can you trade indices

Open Trading account

-

Lightning-fast execution across a wide variety of global markets

Gain seamless access to 15,000 global markets, with dependable and efficient execution

-

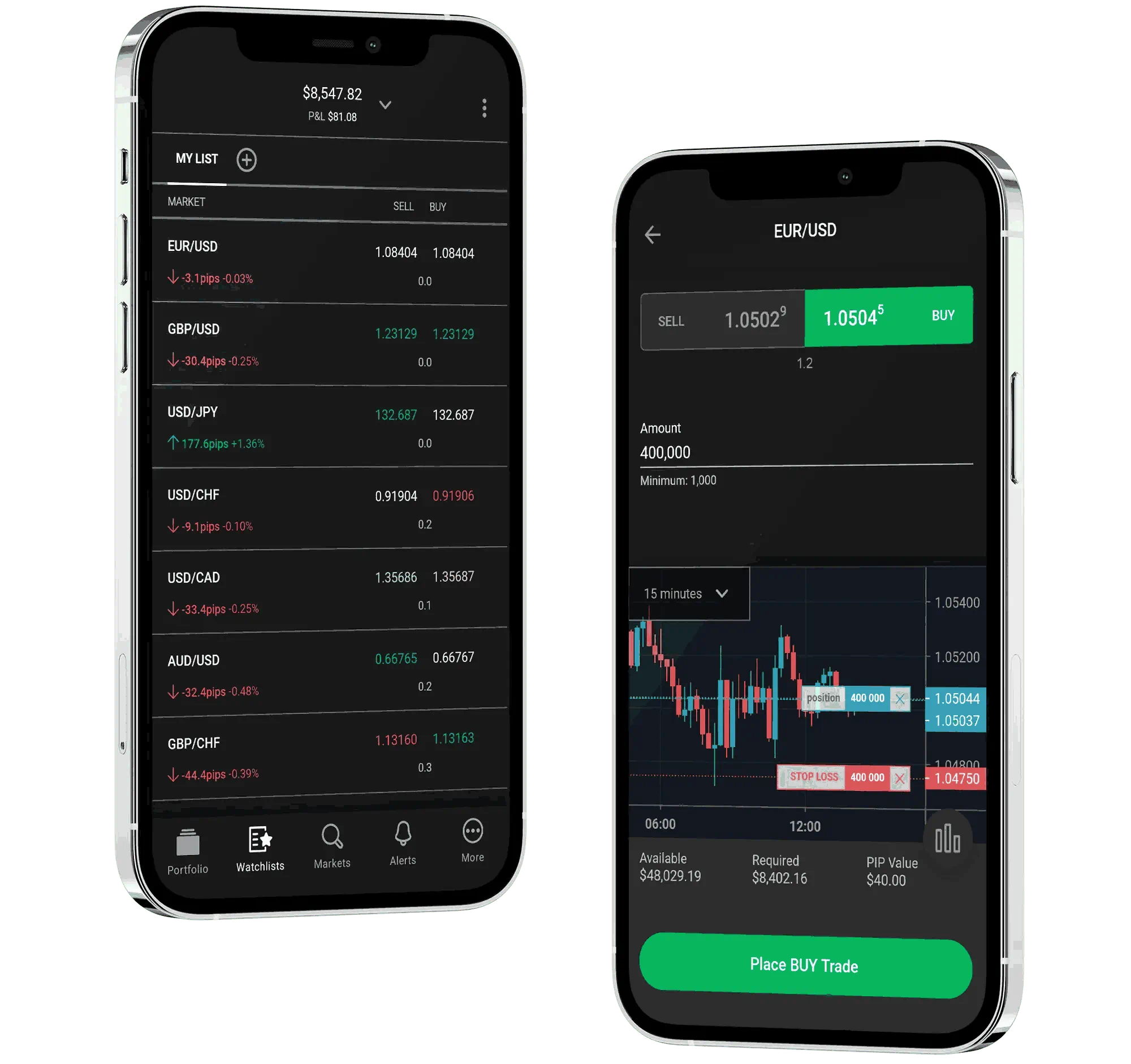

Trade effortlessly anytime, anywhere

Experience trading on the go with our intuitive, award-winning app designed for ultimate performance

-

Trade with confidence with a provider you can trust

Backed by over 10 years of expertise, we’re committed to delivering a market-leading service you can rely on

FAQ

Index trading involves speculating on the price movements of a market index, such as the S&P 500, Dow Jones, or NASDAQ. Traders can profit from the fluctuations in the value of the index without owning the individual stocks that make up the index. It offers a way to trade a basket of stocks in one transaction.

In index trading, traders can buy or sell contracts that track the performance of a specific market index. When the value of the index moves in the direction you predicted, you make a profit. Indexes are generally more stable than individual stocks, making them an attractive option for diversification.

The benefits of index trading include diversification, as you gain exposure to an entire market or sector through one trade. It reduces risk compared to individual stock trading, and you can profit from both rising and falling markets by going long or short. Additionally, it offers lower volatility and smoother price movements.

Yes, many brokers offer the option to trade indexes with leverage. Leverage allows you to control a larger position with a smaller investment, potentially increasing your profits. However, it is essential to use leverage cautiously, as it also increases the risk of losses.

Some of the most popular indices to trade include the S&P 500, which tracks the top 500 companies in the US, the NASDAQ 100, which focuses on tech stocks, and the FTSE 100, representing the 100 largest companies on the London Stock Exchange. These indices provide traders with diverse exposure to global markets.